Don't Mix Personal Expenses with Business

Monday June 5, 2017

Hey Entrepreneurs - Is this your face when you look at your bank or credit card statements and you are trying to remember if that charge was a business expense or a personal expense? "I can't remember!" Change your habits - use your business checking and credit card only for business transactions. Transfer funds or do an owner's draw to your personal account to pay for personal expenses. Whether you do your own bookkeeping or you delegate it to someone, you can avoid wasting precious time sorting things out, coding, and pulling receipts to... Read More

On The Horizon

Monday August 15, 2016

As entrepreneurs and small business owners we sometimes get tunnel vision. We work on the things that we enjoy, are good at, or the task right in front of us at the moment. But we all know there is a long list of tasks that also must be done in running a business. That long list can cause you stress and can get overwhelming as time goes on. Do yourself and your business a favor and delegate some of those tasks. Find people you can trust to help you. When you let it go and get it done, your outlook on the horizon will be much improved. ... Read More

Experience Pros Radio Clip June 2016

Tuesday June 28, 2016

Experience Pros Radio Clip with Brenda Bowen, Angel Tuccy Eric Reamer. How do you stay relevant? Click on the link to listen in ...... { Experience Pros Radio with Brenda Bowen June 8, 2016 } ... Read More

Split Transactions

Wednesday June 22, 2016

Sometimes you have a transaction that needs to be posted to more than one account - this is called a split transaction. In QuickBooks when you enter a transaction, you will find a split button on the bottom left of the screen. Click split, then divide the transaction by listing the different accounts on each line and the dollar amount that should be coded to each. Consider It Done! ... Read More

Estimated Tax Payment Due June 15

Wednesday June 8, 2016

Who doesn't like a reminder? You juggle many hats as a business owner and things are ramping up for a busy summer. You have paid yourself with an owner's draw, have been setting aside money for estimated taxes, now is the time to make your payment. Go online and schedule your payment for the April 1 - May 31, 2016 period. #selfemployed #entrepreneur #taxreminder #fanbrag #peaceofmind ... Read More

Reflection

Wednesday May 25, 2016

"Without reflection, we go blindly on our way, creating more unintended consequences and failing to achieve anything useful." - (Margaret J. Wheatley) When is the last time you stopped to reflect? You and your business deserve and need it. Block some time out on your calendar and schedule some reflection time soon. ... Read More

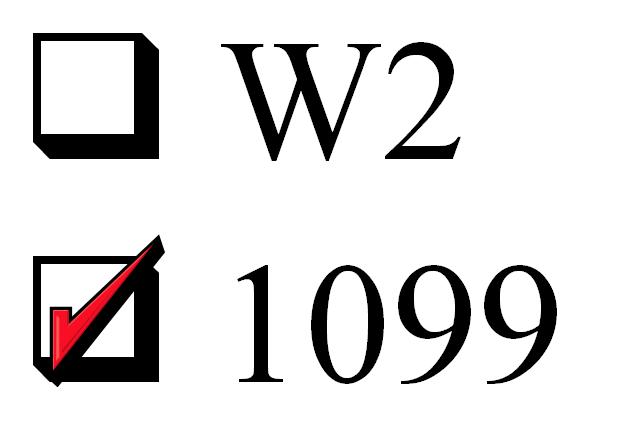

End Of Year Approaching - Update your 1099 Info

Wednesday December 2, 2015

Now is the time to go through your vendors and make sure that you have the "Vendor Eligible for 1099" box checked in QuickBooks, you have a current address, and Tax ID entered. You will be happy you did come January when your 1099s need to be processed and mailed. ... Read More

Preparing for 1099s

Tuesday January 13, 2015

Have you paid someone $600.00 or more during the year for a service? Are they a corporation? Not sure,best to ask them. If they are not a corporation, then you will need to get a W-9 from them. This will have their legal name, address, and taxpayer ID number that you will need to create a 1099 for them at the end of the year. The deadline for mailing 1099s is January 31 to the recipient, and then the forms can be e-filed. Best practice -during the year collect that information on any new service providers,subcontractors,and independent... Read More

Saving Cash Receipts?

Tuesday November 25, 2014

Avoid paying cash for business expenses if you can. If you do, be great at saving receipts for your bookkeeper so she can record them. Better way - use a debit card, credit card, or check. Anything that shows up on a statement. ... Read More